© 2024 Bemobi. All rights reserved.

Solutions

Digital Subscriptions

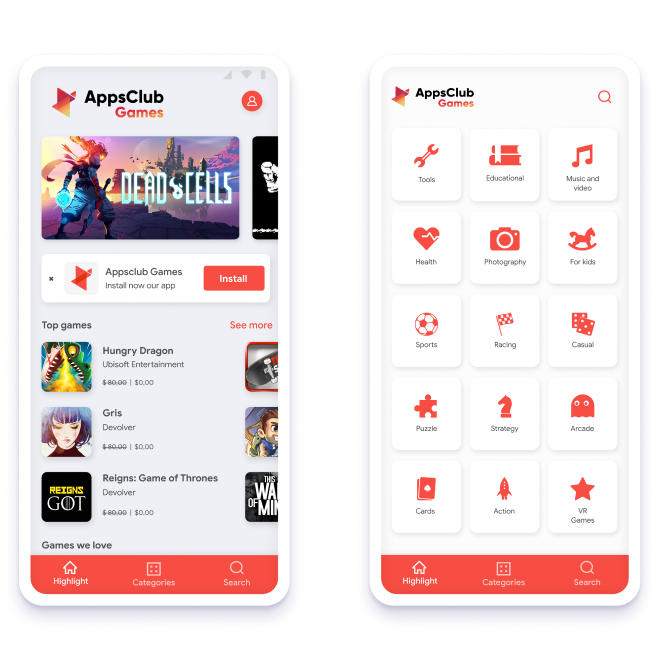

The definitive Apps & Games subscription service!

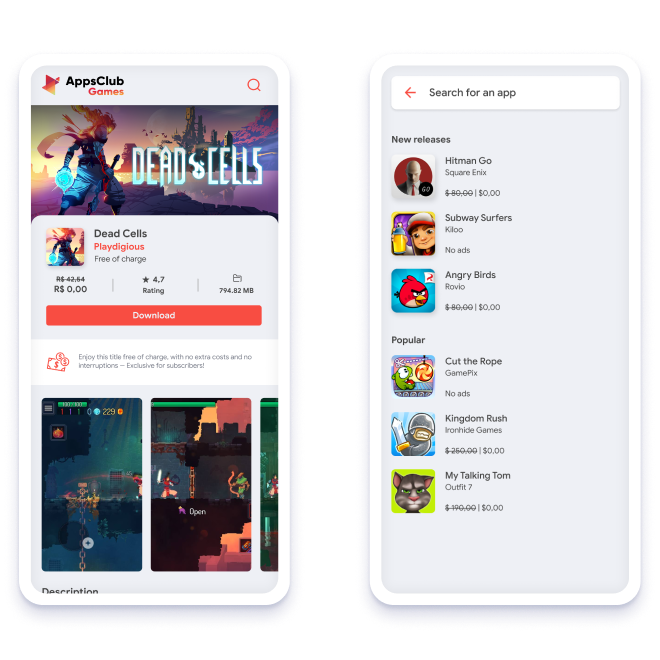

Apps Club is a subscription-based service with an "all-you-can-eat” model. Users pay a recurring subscription fee and get all the games, apps, and in-app items available in our catalog at no extra cost!

Challenge

Monetization gap for Apps&Games developers in emerging markets (e.g. pricing and payment challenges)

Mobile Carriers seek ways to differentiate their services and monetize their large customer bases generating new sources of revenue.

Business Partner Opportunities

Developers: new incremental revenue streams addressing non monetizable users with no new integration or development need.

Carriers/DigitalBanks: new increments revenue streams from existing user base.

Users benefits

Access to a vast catalog of top-quality titles, with no ads.

Dramatically lower price vs compared AppsStore alternatives.

No need for credit-cards.

Features Highlight

Free of advertisements

No interruptions while using the best Games and Applications on the market.

In-house purchases unlocked

No additional fees and all the benefits of internal purchases released.

No external links

One seamless experience with no distractions.

One single subscription

No need for several different subscriptions to enjoy apps.

Digital Subscriptions + Loop Digital Engagement Platform

Premium subscription services and orchestration for mobile apps and games

Digital Payments

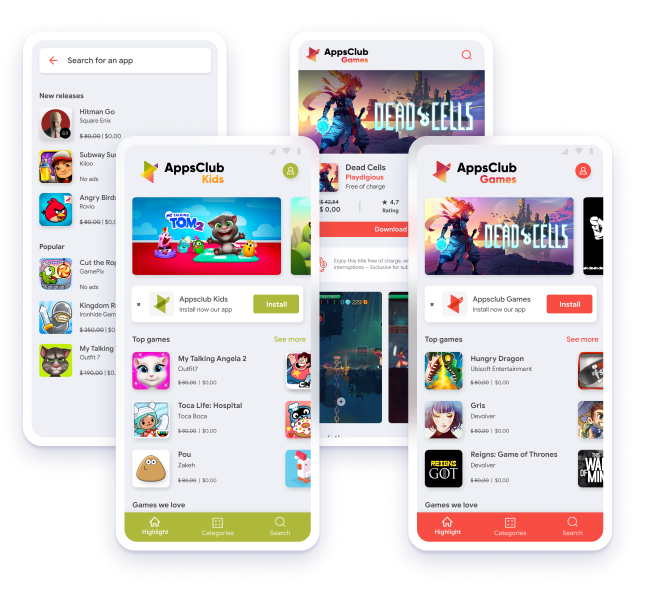

AppsClub

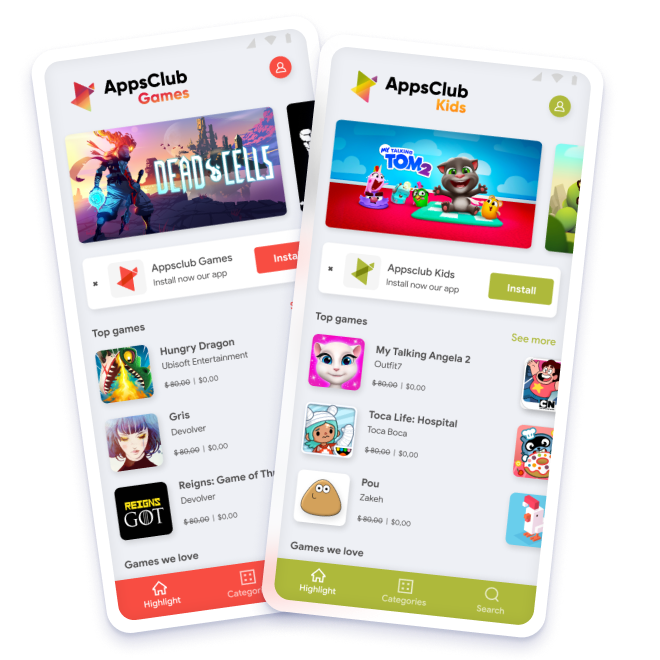

GamesClub

KidsClub

AppsClub has over 40 million global subscriptions and operates using a white-label model.

With Loop Engagement Platform, we deliver personalized offers and deals to users based on their context and profiles.

Loop integrates mobile operator's payment and subscription channels, along with third-party services, to streamline the sign-up process, increasing conversion rates, revenue, and enhancing user experience.

Subscribe through one of our partners, paying one single subscription, and enjoy more than 1,000 titles present in the Apps Club’s catalog, including the world’s best apps and games.

Completely unlimited downloads and usage

No ads and with all in-app purchases unlocked

No need for a credit card

Over 20,000 USD worth of apps and in-app purchases for a small fixed price

100% secure

More than 1,000 top-quality apps and games

Main Verticals

AppsClub

The best freemium and premium apps and games on the market are in one place, with no ads and all in-app purchases unlocked without any extra cost.

AppsClub Games

Designed for casual and hardcore gamers alike and focused on exclusive top-quality content, AppsClub Games offers the best mobile games in one place!

AppsClub Kids

Offers a playful interface based on popular characters and parent-child moments. AppsClub Kids also brings the option to supervise children's usage through simple and easy-to-use parental control.

Content

Hundreds of Apps

- 1500+

Mobile Apps title

- 1000+

Mobile Games title

- 700+

Apps for Kids

- 150

+Health and education apps*

*International only

The Best Partners

Contet Key-partners

Who Trusts Us

Clients

Let's Talk!